Invest in Chamberí, one of the most solicited areas in Madrid!

Type of opportunity: Participative loan1. Modality: Buy-to-let

We bring you a new opportunity that consists of the granting of a loan to a project developer for the purchase of a home in the exclusive Chamberí district. The area is very traditional and retains the castizo, stately and aristocratic character that has remained intact to this day. Nowadays, it has become one of the most attractive gastronomic areas of the city.

It’s a 47m2 apartment that will be renovated following the most demanded distribution of the area, two bedrooms, a bathroom and a living room with American style kitchen.

It will be completely renovated and decorated under the Home Staging2 strategy with the aim of increasing the commercialization speed for its traditional rental.

The project developer will be responsible for carrying out all the tasks and necessary steps to carry out the sale, execute and control the rehabilitation of the property, carry out the marketing strategy (rent and subsequent sale in this case) or by itself; well through third parties.

This neighborhood is an excellent option for students, since it is very close to the University City. It has a wide variety of leisure and commercial areas at street level, and good transport links (Moncloa and Argüelles, and one of the main bus stations in Madrid).

The boundaries of the neighborhood of Gaztambide are Calle de Cea Bermúdez to the north, Calle Alberto Aguilera to the south, Calle de Blasco de Garay to the east, and Calle Princesa, Arcipreste de Hita and Isaac Peral to the west.

The area also benefits from its close proximity to the well-known Parque del Oeste, an oasis in the city center.

Why invest?

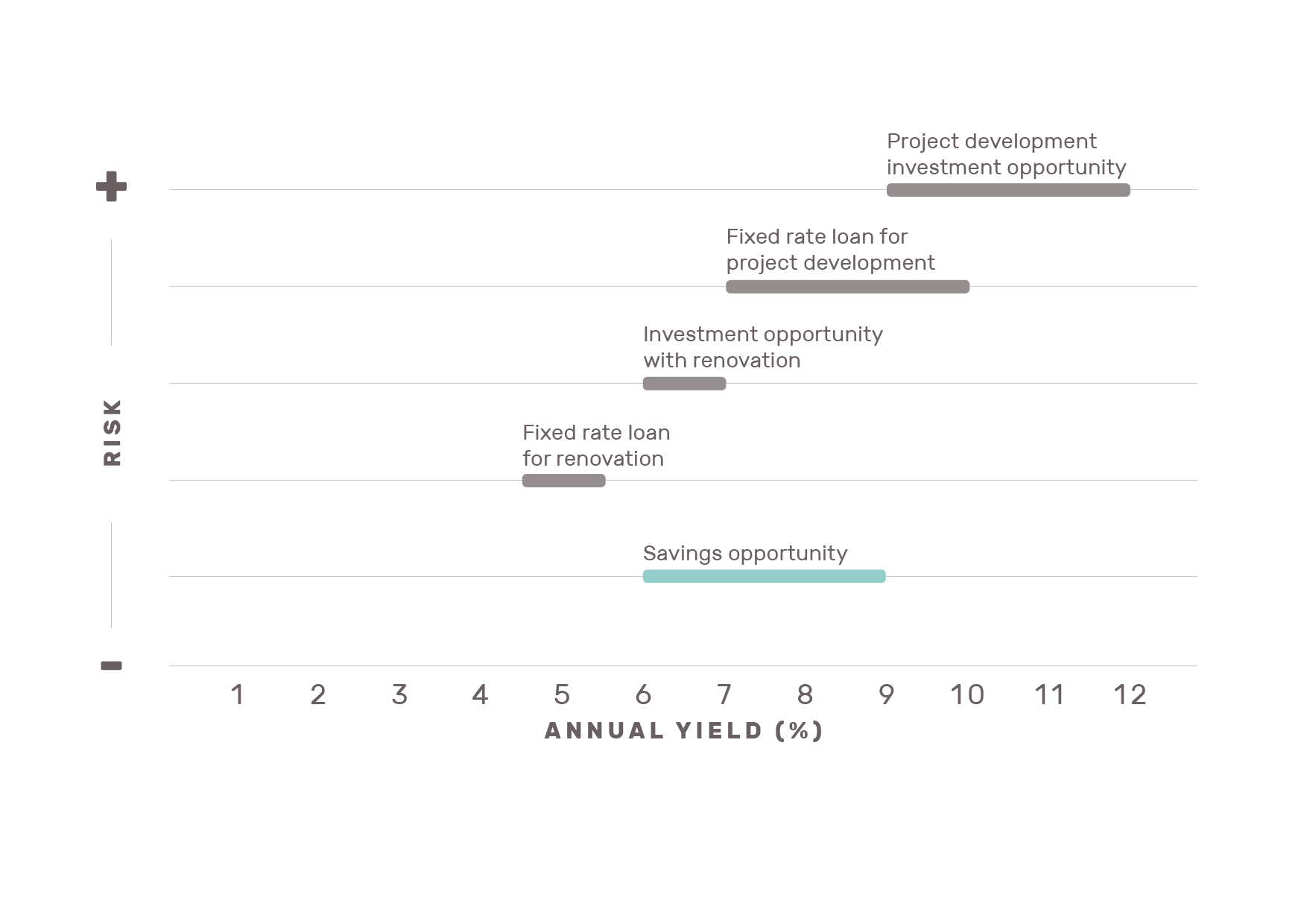

On the following graph you can see the yield-risk relationship for this type of this type of opportunity: buy-to-let.

Invest in Chamberi and profit from your savings!

Risks and warnings: HOUSERS is not a credit institution or an investment services company. Investment in projects published by HOUSERS is not covered by any investment fund. This project has not been supervised by the CNMV, the Bank of Spain or any other regulator, Spanish or foreign. The information provided by the promoter has not been reviewed by the CNMV nor is it a prospectus approved by the CNMV. HOUSERS does not provide financial advice, so nothing on this website should be interpreted as such. The investment in this project involves the following risks: risk of total or partial loss of the invested capital, risk of not obtaining the expected cash yield and risk of illiquidity to recover the investment as well as the risk that the tenant does not pay the monthly rent or be late in payment; subordinate character of the loan, in particular to the mortgagee, in those cases in which the acquisition of the property object of the project is financed additionally by means of loans with mortgage guarantee. The expressed profitability is based on mere estimates of the future evolution of the amount of the rents and the prices of the properties, which may or may not occur. The promoter accumulates 13 projects on the platform, which entails an additional concentration risk. The promoter has limited own resources so that his responsibility in the project is limited to 3,000. The maximum term to invest in this opportunity may be lengthened by an additional 25% to the term initially foreseen, in accordance with the Law for the Promotion of Business Financing. Likewise, HOUSERS may close the financing of this opportunity / project closed when it has been financed by 90%.

* The contact between investors in the CCD, as well as the possible formalization of the sale, should be done separately without any intervention of the platform and in accordance with the provisions of the general regulations that affect the transmissibility of the instrument.

1 Intermediary financing instrument between the capital (equity participation) and the long-term loan. Participative loans are loans (that is, the promoter is obliged to return the financing received) whose characteristic is that the interest received by the person who lends the money depends on the benefits obtained by the person who receives the loan.

2The estimated annual net yield from rental has been provided by an Appraiser registered by the Bank of Spain, may be higher or lower than the published and may not be constant over time.

3The estimated accumulated net yield shown comes from the rental and the possible revaluation of the sale and may be higher or lower than the one published based on the rent and the sale price achieved, this estimate has been made by the developer from its own studies and Big Data tools. This estimate has been contrasted HOUSERS using own tools.

In Spain, Housers is a crowdfundig platform registered next to CNMV (Spanish Regulator) with register number 20. Housers is a platform that facilitates access to loans related to real estate transactions promoted by third-party companies, previously analyzed and validated. Housers does not offer financial advice and none of the proposed activities should be considered as such. The analyzes shown in these pages are general information and do not in any way constitute specific advice. The projects illustrated are not subject to the supervision of any national or international financial authority or regulator. The transactions presented are forecasts only and as such, they may be subject to change. Investing through Housers involves risks, including illiquidity, loss of investment, and it should only be done as part of a diversified portfolio. Your capital is at risk.

.