Opportunity of short-term investment in Madrid!

Type of Opportunity: Loan1 Modality: Buy-to-sell

The purpose of this opportunity is to concede a loan to a project developer for the purchase, renovation and decoration, through Home-Staging2, of an apartment with the objective of maximizing the sale expected in 12 months.

It is located in a building on Avenida de América itself, the beginning of the exclusive Barrio de Salamanca and next to Avenida Camilo José Cela, Parque de la Avenidas and Avenida de Bruselas. It’s in the Prosperidad neighborhood, in the district of Chamartín. A few meters away we find iconic buildings such as Torres Blancas or the famous Puerta de América hotel.

The area experiences a high demand for purchase, demonstrated by other properties already sold on the platform such as Malcampo 27 or Vinaroz 26.

More specifically, it is located on Avenida de América 42, in a typical brick building of the classic 80s-90s style of construction. The 91m2 house is exterior, and the building has an elevator as well as a doorman. It will be renovated following the most demanded distribution of the area:

The renovation will be done under the turnkey model, meaning the budget will be closed and no changes can be made.

The project developer will be responsible for carrying out all the tasks and management necessary to make the sale, execute and control the rehabilitation of the property, carry out the marketing strategy well by itself; well through third parties.

The home will be perfect for both a buyer profile and an investor. If the buyer profile is an investor, it can be rented once renovated, furnished and decorated around € 1,350/month as a conservative base. In the case of being a buyer you will get a fully qualified house to live or to rent and in one of the main roads of the capital.

Why invest?

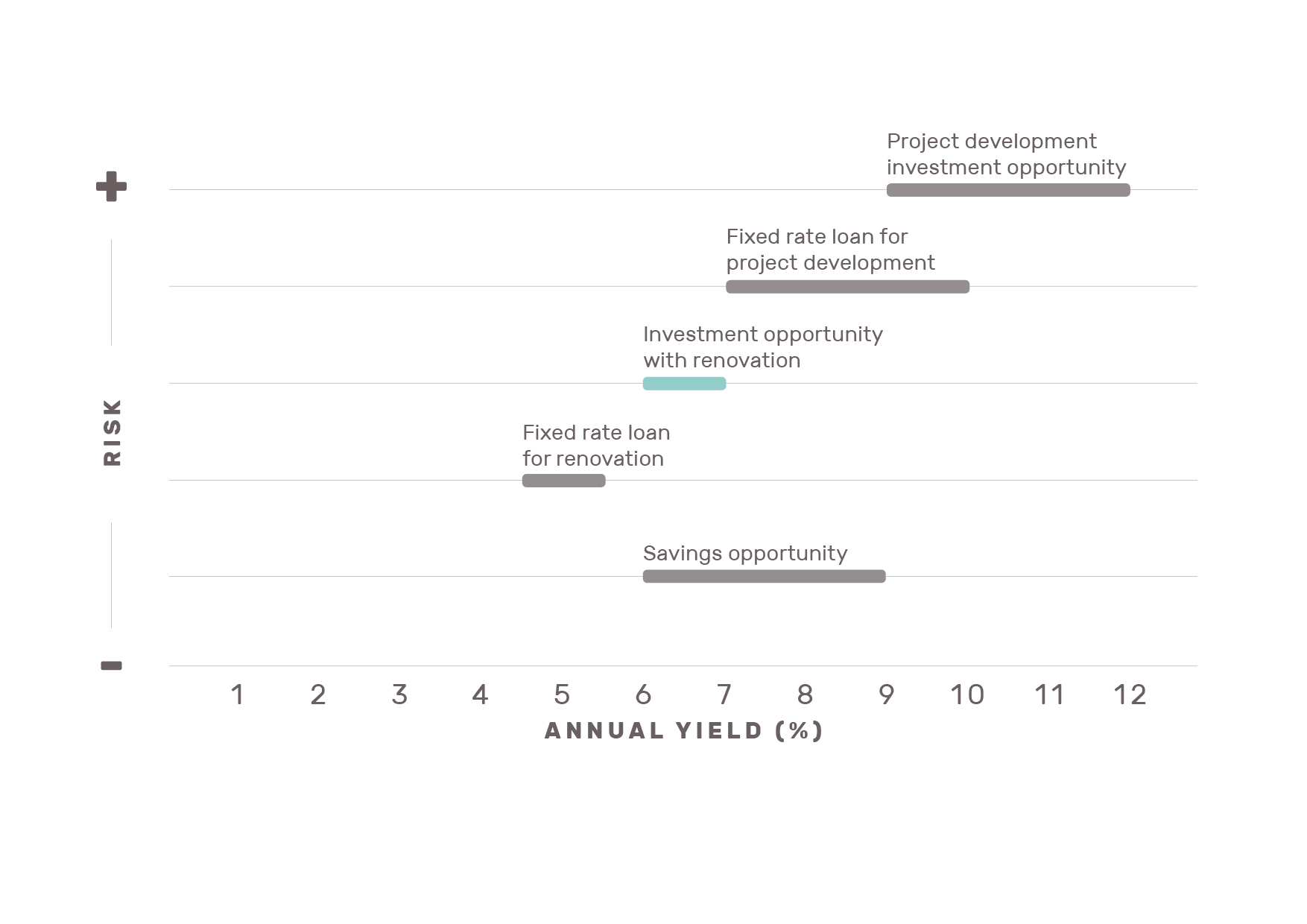

On the following graph you can see the yield-risk relationship for this type of opportunities: buy-to-sell for renovation.

Start saving in 2018 with the real estate market!

1 Intermediary financing instrument between the capital (equity participation) and the long-term loan. Participative loans are loans (that is, the promoter is obliged to return the financing received) whose characteristic is that the interest received by the person who lends the money depends on the benefits obtained by the person who receives the loan.

2Marketing strategy based on techniques that enhance the home and give it a more attractive look for potential buyers. Take a look at one of our flats sold under this modality here.

3The total estimated return shown of the possible revaluation of the sale, may be higher or lower than that published based on the sale price achieved, said estimate has been made by the developer based on their own studies and Big Data tools. This estimate has been contrasted HOUSERS using own tools.

Risks and warnings: HOUSERS is not a credit institution or an investment services company. Investment in projects published by HOUSERS is not covered by any investment fund. This project has not been supervised by the CNMV, the Bank of Spain or any other regulator, Spanish or foreign. The information provided by the promoter has not been reviewed by the CNMV nor is it a prospectus approved by the CNMV. HOUSERS does not provide financial advice, so nothing on this website should be interpreted as such. The investment in this project involves the following risks: risk of total or partial loss of the invested capital, risk of not obtaining the expected cash yield and risk of illiquidity to recover the investment; subordinate character of the loan, in particular to the mortgagee, in those cases in which the acquisition of the property object of the project is financed additionally by means of loans with mortgage guarantee. The expressed profitability is based on mere estimates of the future evolution of real estate prices, which may or may not occur. The promoter accumulates a project on the platform which entails an additional risk of concentration. The promoter has limited own resources so that his responsibility in the project is limited to 3.010. The maximum term to invest in this opportunity may be lengthened by an additional 25% to the term originally foreseen, in accordance with the Law for the Promotion of Business Financing. Likewise, HOUSERS may close the financing of this opportunity / project closed when it has been financed by 90%.

In Spain, Housers is a crowdfundig platform registered next to CNMV (Spanish Regulator) with register number 20. Housers is a platform that facilitates access to loans related to real estate transactions promoted by third-party companies, previously analyzed and validated. Housers does not offer financial advice and none of the proposed activities should be considered as such. The analyzes shown in these pages are general information and do not in any way constitute specific advice. The projects illustrated are not subject to the supervision of any national or international financial authority or regulator. The transactions presented are forecasts only and as such, they may be subject to change. Investing through Housers involves risks, including illiquidity, loss of investment, and it should only be done as part of a diversified portfolio. Your capital is at risk.

.