Maximize your profits with short-term rent in the center of Madrid!

Type of Opportunity: Loan1 Modality: Buy-to-let

New opportunity in the capital to finance a project developer for the purchase of a house already renovated and furnished in the fashionable neighborhood with great potential: Lavapiés (City Center).

The apartment will be offered as a short term rental, and it only needs some final touches with the means of improving its decoration for its rent and future sale.

It is important to keep in mind:

The apartment is located on Calle Escuadra 13, on the triangle between Anton Martin, Tirso de Molina and Lavapies Plaza. It is one of the points in the capital with the most multicultural movement and it has great success among the young and the tourists that visit the capital.

In close proximity to the apartment is Plaza de Lavapies, calle Atocha, Tirso de Molina, El Rastro, the Reina Sofia Museum, the Nuevo Apolo Theater, Monumental Theater, and the San Miguel Market.

This is the perfect location for this type of rental, as seen in our previous projects in the same neighborhood, like La Paloma, that was also placed as a short-term rent and that is currently presenting high occupation indexes.

To estimate the annual net yield for the rent, three scenarios have been taken into account depending on the monthly stays;

The 41m2 apartment is distributed in a large open space with a bed and an open kitchen with living room. It's interior and has an exclusive and private patio which gives it a special charm.

The project developer will be responsible for carrying out all the tasks and necessary steps to make the purchase, decorate the space, carry out the marketing strategy (rent by days and subsequent sale in this case) or by itself; well through third parties. In addition to doing a follow-up during the whole life of the project and being in charge of carrying out the necessary tasks for the day-to-day management of the property including the necessary tasks for the holiday operations, that is, maintenance, cleaning, check in, check out, procedures legal, and everything necessary to make the operation profitable.

Why invest?

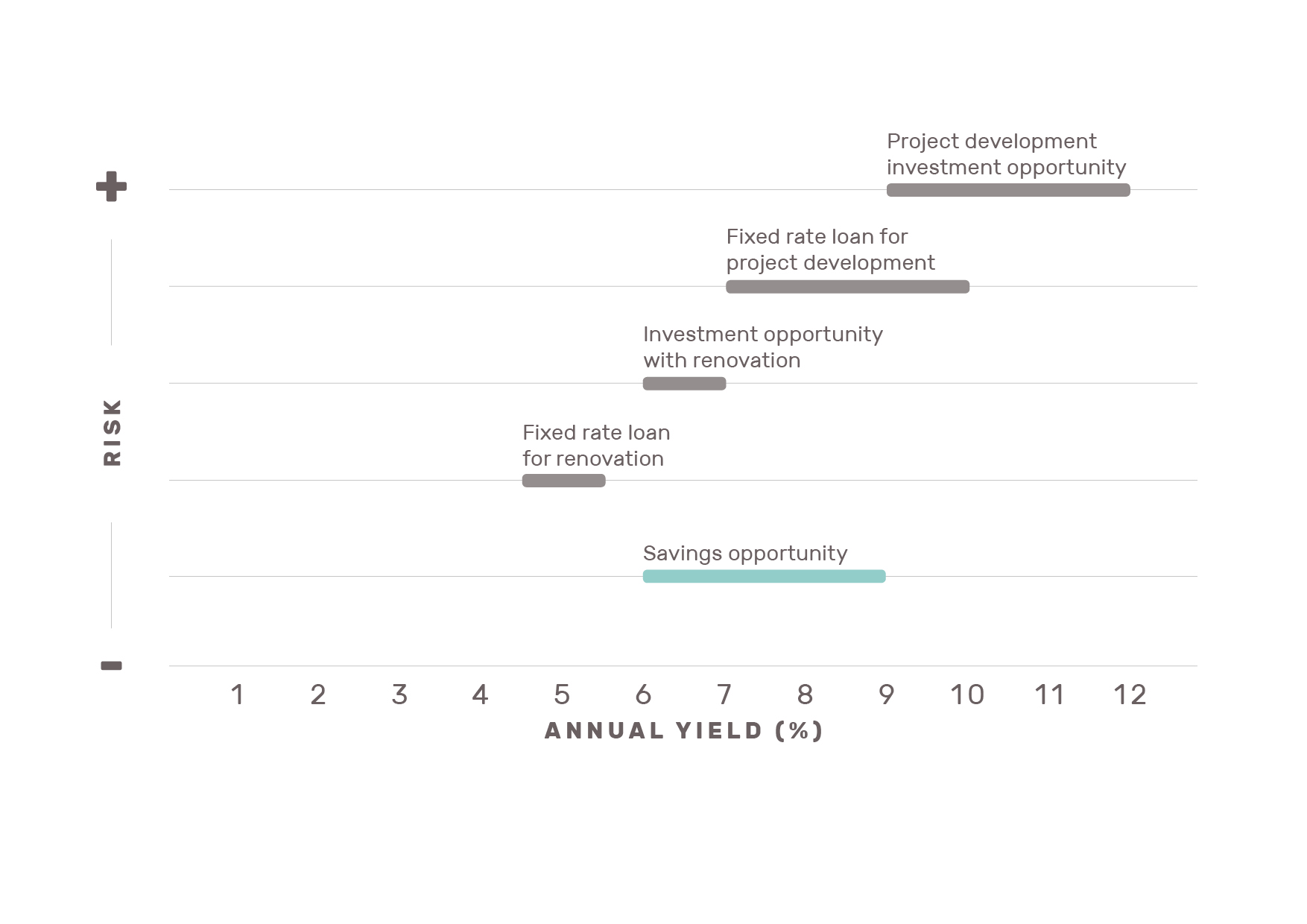

In the following graphic you can see the yield-risk relationship for this type of opportunity, buy-to-let:

Risks and warnings: HOUSERS is not a credit institution or an investment services company. Investment in projects published by HOUSERS is not covered by any investment fund. This project has not been supervised by the CNMV, the Bank of Spain or any other regulator, Spanish or foreign. The information provided by the promoter has not been reviewed by the CNMV nor is it a prospectus approved by the CNMV. HOUSERS does not provide financial advice, so nothing on this website should be interpreted as such. The investment in this project involves the following risks: risk of total or partial loss of the invested capital, risk of not obtaining the expected cash yield and risk of illiquidity to recover the investment as well as the risk that the tenant does not pay the monthly rent or be late in payment; subordinate character of the loan, in particular to the mortgagee, in those cases in which the acquisition of the property object of the project is financed additionally by means of loans with mortgage guarantee. The expressed profitability is based on mere estimates of the future evolution of the amount of the rents and the prices of the properties, which may or may not occur. The promoter accumulates X projects on the platform, which entails an additional risk of concentration. The promoter has limited own resources so that his responsibility in the project is limited to 3,000. The maximum term to invest in this opportunity may be lengthened by an additional 25% to the term initially foreseen, in accordance with the Law for the Promotion of Business Financing. Likewise, HOUSERS may close the financing of this opportunity / project closed when it has been financed by 90%.

1 Intermediary financing instrument between the capital (equity participation) and the long-term loan. Participative loans are loans (that is, the promoter is obliged to return the financing received) whose characteristic is that the interest received by the person who lends the money depends on the benefits obtained by the person who receives the loan.

2 The estimated accumulated net yield shown comes from the rental and the possible revaluation of the sale and may be higher or lower than the one published based on the rent and the sale price achieved, this estimate has been made by the developer from its own studies and Big Data tools. This estimate has been contrasted by HOUSERS using our own tools.

The calculation methodology for obtaining the annual net profitability estimated by the rent, the revaluation of the area and the estimated accumulated net profitability are based on the appraisal report, by a registered appraiser and approved by the Bank of Spain.

In Spain, Housers is a crowdfundig platform registered next to CNMV (Spanish Regulator) with register number 20. Housers is a platform that facilitates access to loans related to real estate transactions promoted by third-party companies, previously analyzed and validated. Housers does not offer financial advice and none of the proposed activities should be considered as such. The analyzes shown in these pages are general information and do not in any way constitute specific advice. The projects illustrated are not subject to the supervision of any national or international financial authority or regulator. The transactions presented are forecasts only and as such, they may be subject to change. Investing through Housers involves risks, including illiquidity, loss of investment, and it should only be done as part of a diversified portfolio. Your capital is at risk.

.