We’re back in the Spanish Capital, Madrid, with a unique opportunity!

Type of Opportunity: Loan1 Modality: Saving

Exceptional opportunity that has as an objective to finance a project developer for the purchase of an already reformed property for lease and future sale in the Cuatro Caminos neighborhood.

We’re talking about a neighborhood where other similar projects have been carried out, such as Bellas Vistas, Lerida, Coruña or Dulcinea.

On this occasion, the property is located in a building next to one of the most representative office areas of Madrid, the Central Business District (CBD) of Azca. Specifically, we are talking about Calle Artistas 5, which leads directly to the Cuatro Caminos roundabout, which belongs to the Tetuán district, one of the areas with the most consolidated urban environment.

Although the property is ready to enter, the developer will dedicate a part of the investment to decorating the property so that it can be rented as quickly as possible under the Home Staging strategy.2

Madrid is one of the best opportunities to choose where to invest and with this project:

The 59m2 property is on the second floor, interior of the building and apart from having direct views to Picasso Tower, it also has a very demanded distribution:

It's next to Raimundo Fernández de Villaverde, a main corridor that runs between Cuatro Caminos to Paseo de Castellana and separates the districts of Chamberí and Tetuán. It is undoubtedly one of the main avenues of the capital, full of traditional residential buildings and full of services in all the premises of the ground floors.

From the most immediate surroundings, Cuatro Caminos, Calle Orense, Avenida General Perón, Moda Shopping, Azca, Torre Picasso or Santiago Bernabéu Stadium stand out.

The project developer will be responsible for carrying out all the tasks and necessary steps to perform the acquisition, execute and control the decoration of the property, carry out the marketing strategy (rent and subsequent sale in this case) by itself or through third parties. In addition the project developer will follow-up throughout the life of the project and be responsible for performing the necessary tasks for the management of the day to day of the property.

Why invest in Artistas?

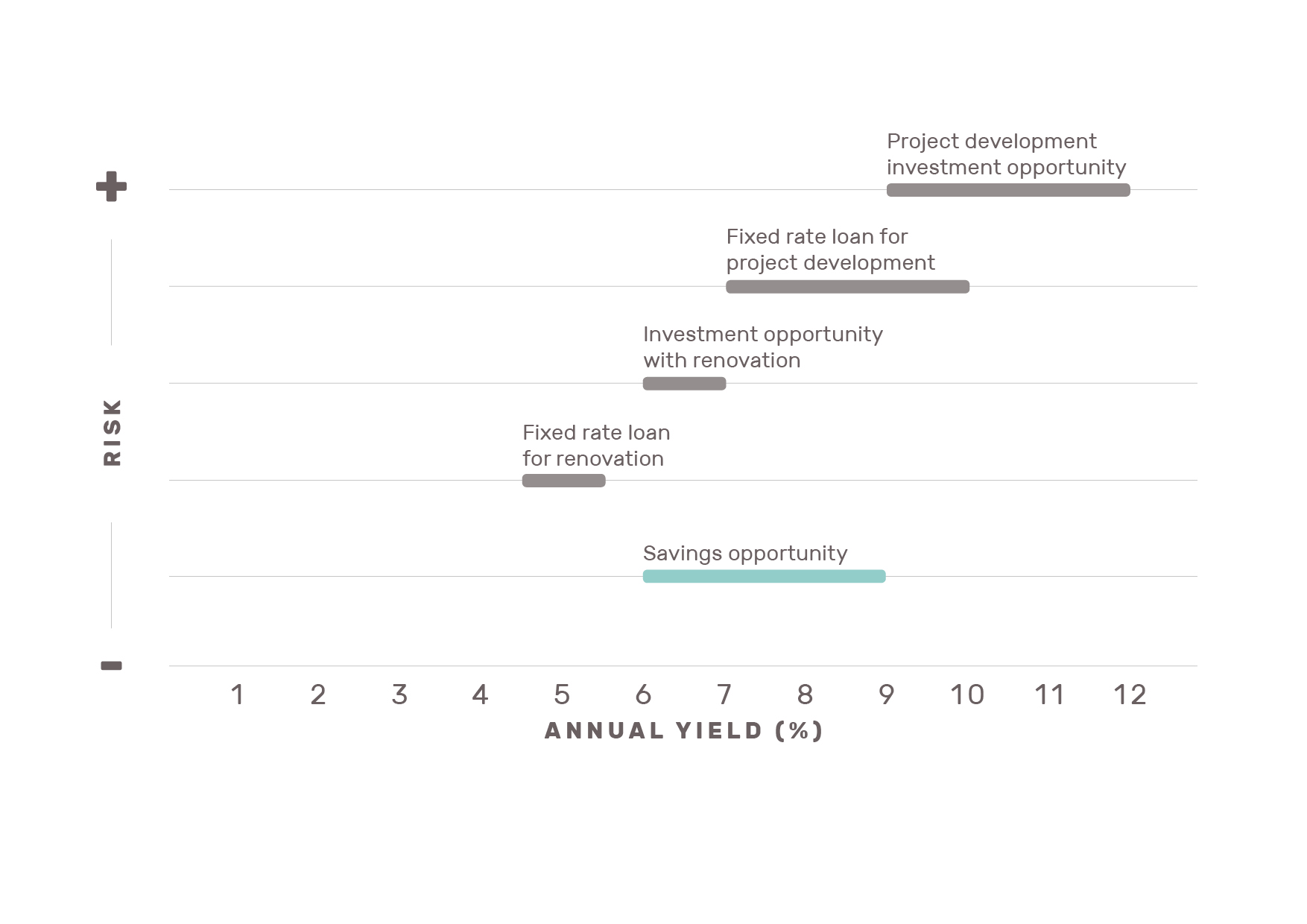

On the following graph, you can see the yield-risk relationship for this type of opportunities: Saving.

If you are looking where to invest, don’t look any further, Madrid is the answer!

If you are looking where to invest, don’t look any further, Madrid is the answer!

Risks and warnings: Housers is not a credit institution or an investment services company. Investment in projects published by HOUSERS is not covered by any investment fund. This project has not been supervised by the CNMV, the Bank of Spain or any other regulator, Spanish or foreign. The information provided by the promoter has not been reviewed by the CNMV nor is it a prospectus approved by the CNMV. Housers does not provide financial advice, so nothing on this website should be interpreted as such. The investment in this project involves the following risks: risk of total or partial loss of the invested capital, risk of not obtaining the expected cash yield and risk of illiquidity to recover the investment as well as the risk that the tenant does not pay the monthly rent or be late in payment; subordinate character of the loan, in particular to the mortgagee, in those cases in which the acquisition of the property object of the project is financed additionally by means of loans with mortgage guarantee. The expressed profitability is based on mere estimates of the future evolution of the amount of the rents and the prices of the properties, which may or may not occur. The promoter accumulates X projects on the platform, which entails an additional risk of concentration. The promoter has limited own resources so that his responsibility in the project is limited to 3,000. The maximum term to invest in this opportunity may be lengthened by an additional 25% to the term initially foreseen, in accordance with the Law for the Promotion of Business Financing. Likewise, HOUSERS may close the financing of this opportunity / project closed when it has been financed by 90%. You have enlarged this information here.

1 Intermediary financing instrument between the capital (equity participation) and the long-term loan. Participative loans are loans (that is, the promoter is obliged to return the financing received) whose characteristic is that the interest received by the person who lends the money depends on the benefits obtained by the person who receives the loan.

2 Marketing strategy based on techniques that enhance the home and give it a more attractive look for potential buyers. Take a look at one of our flats sold under this modality here.

3 The estimated annual net return from rent estimated by HOUSERS from its own studies and tools may be higher or lower than published and may not be constant over time. For a more accurate calculation of profitability this is reviewed every three months.

4 The estimated accumulated net profitability shown comes from the rental and the possible revaluation of the sale and may be higher or lower than the published one based on the rent and the sale price achieved, this estimate has been made by HOUSERS from its own studies and tools.

The calculation methodology for obtaining the annual net profitability estimated by the rent, the revaluation of the area and the estimated accumulated net profitability are based on the appraisal report, by a registered appraiser and approved by the Bank of Spain.

In Spain, Housers is a crowdfundig platform registered next to CNMV (Spanish Regulator) with register number 20. Housers is a platform that facilitates access to loans related to real estate transactions promoted by third-party companies, previously analyzed and validated. Housers does not offer financial advice and none of the proposed activities should be considered as such. The analyzes shown in these pages are general information and do not in any way constitute specific advice. The projects illustrated are not subject to the supervision of any national or international financial authority or regulator. The transactions presented are forecasts only and as such, they may be subject to change. Investing through Housers involves risks, including illiquidity, loss of investment, and it should only be done as part of a diversified portfolio. Your capital is at risk.

.